About Us

Lakeview Growth Management operates as an Independent Sponsor firm, uniquely positioned to acquire and grow small to medium-sized businesses. This flexible and efficient investment model provides tailored opportunities for investors seeking attractive returns and potential partners seeking strategic guidance without the constraints of traditional private equity structures.

At the helm is Jeffrey Ferguson, a seasoned corporate finance expert and attorney with over two decades of experience advising senior leadership teams across diverse industries. Jeffrey’s deep expertise in mergers and acquisitions, special situations, and corporate banking ensures that Lakeview Growth Management delivers unparalleled value to its partners, leveraging his strategic insights and broad network to drive business success.

Acquisitions

We are seeking to acquire and grow a small to medium-sized business or businesses. Our ideal target is a founder that is interested in succession planning and looking to leave their legacy in trusted hands.

The mission is to identify companies with significant potential for growth and create value for investors while ensuring that the founder and employees of the company benefit from the acquisition.

Our Approach

We look to invest in companies that have a strong workforce-in-place and customer relationships that can be nurtured and grown into the next generation. Lakeview is seeking to acquire a company where investing in its workforce and technology will unlock new opportunities for growth.

Target Industries

Technology-enabled business process services companies in the following industries:

Investment Criteria

Seeking companies with the following characteristics:

EBITDA

Between $1 million and $7 million

Enterprise Value

Between $5 million to $35 million

Business Model

Scalable business model with proprietary technology

Potential

Attractive organic growth opportunities

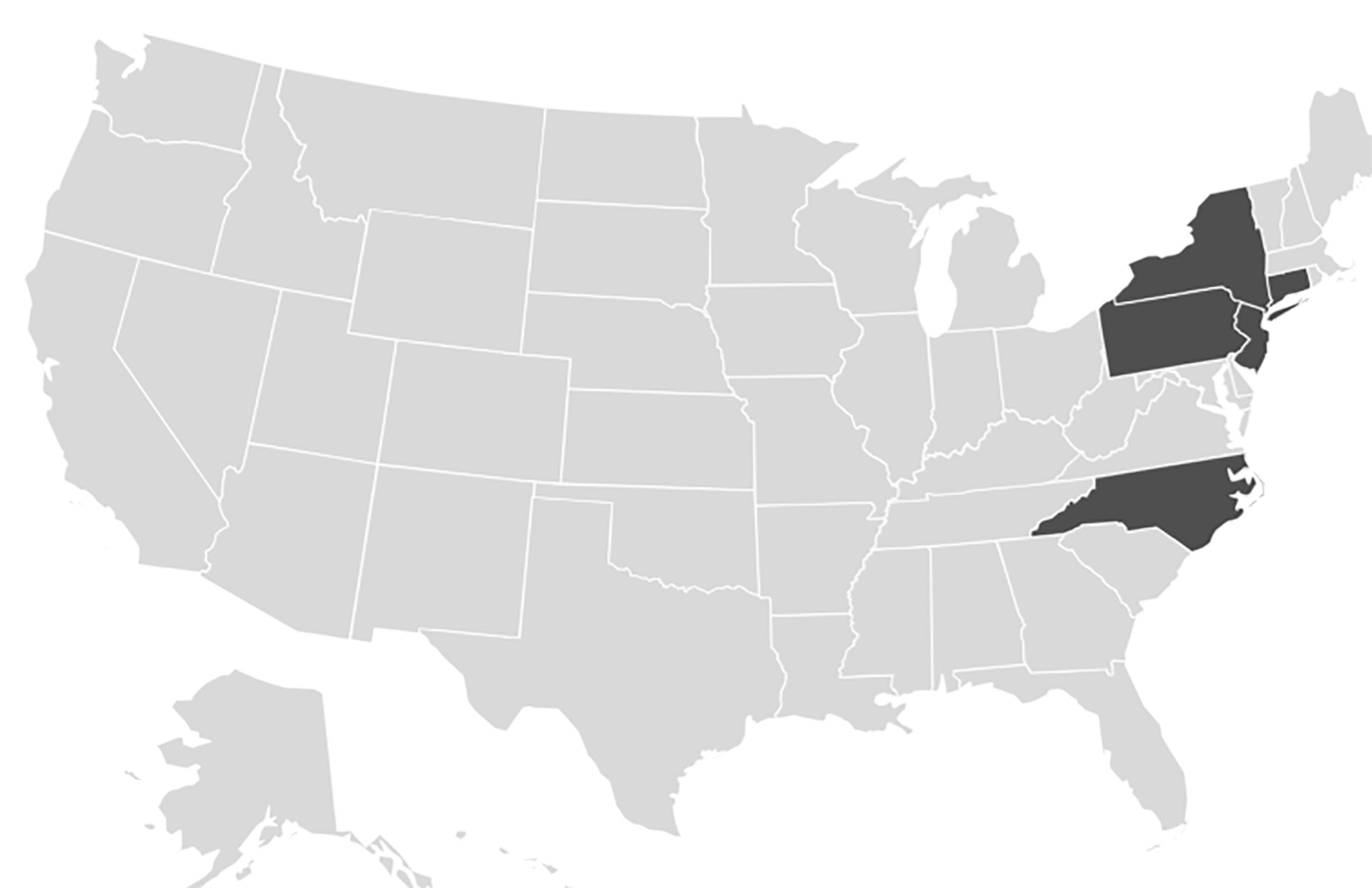

Target Locations

New York, New Jersey, Connecticut, Pennsylvania, North Carolina

Advisory

Lakeview’s founder is a seasoned corporate finance professional, with over two decades of experience in consulting, banking and law. With Jeffrey’s deep network of connections in finance and law, Lakeview, on a stand alone basis and through partnerships, is able to provide institutional quality work product at a considerable cost savings for our clients. Lakeview provides the following services to clients of all sizes:

Our Team

Resources

When founders partner with private equity (PE) firms, understanding deal structures becomes critical. Among the many facets of an acquisition, the deal structure determines how the transaction is financed, the roles of stakeholders, and the eventual path forward for the company. Leveraged buyouts (LBOs) are a cornerstone of private equity deals, and their flexibility allows for various structures, including the increasingly popular hybrid deal structure. Here is what you need to know.

The 2024 Legal Industry Outlook by Lakeview Growth Management highlights key trends shaping the legal sector, including the impact of AI, regulatory changes, and shifting client expectations. Law firms are focusing on technological integration, talent retention, and operational efficiency to stay competitive. The report emphasizes the need for strategic adaptation as market demands evolve, urging firms to embrace innovation and client-centric approaches.

Contact

1178 Broadway, 3rd Floor #3492

New York, NY 10001

"*" indicates required fields