When founders partner with private equity (PE) firms, understanding deal structures becomes critical. Among the many facets of an acquisition, the deal structure determines how the transaction is financed, the roles of stakeholders, and the eventual path forward for the company. Leveraged buyouts (LBOs) are a cornerstone of private equity deals, and their flexibility allows for various structures, including the increasingly popular hybrid deal structure.

Here is what you need to know.

What is an LBO?

A leveraged buyout (LBO) is a transaction where a PE firm acquires a company using a combination of equity (the firm's own capital) and significant debt financing. The acquired company's cash flow and assets typically secure this debt. The goal is to enhance the company's value over time, generate returns for the PE investors, and exit the investment profitably, often through a sale or IPO.

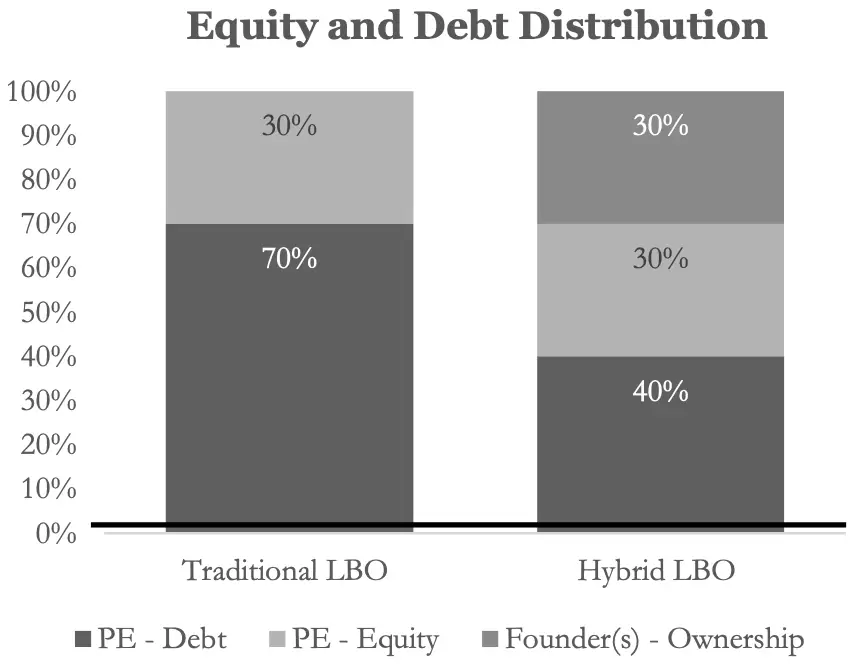

The capital structure in LBOs is generally debt heavy. Senior debt often comprises about 50% of the total capital structure, with subordinated debt and equity financing filling in the rest (Street of Walls). The use of debt enables the PE firm to leverage the acquired company's future cash flows to fund the acquisition, maximizing potential returns on invested capital.

Common LBO Deal Structures

Traditional Buyout:

In a traditional buyout, the private equity firm acquires a majority stake in the company. The deal is primarily financed through debt, with the firm injecting equity to fund the remainder. Founders may retain a minority stake or exit entirely, depending on the terms. This structure is common for companies with stable cash flows that can support higher levels of debt.

Minority Recapitalization:

In a minority recapitalization, the private equity firm takes a minority ownership position. This structure is often used when founders want to retain control but seek growth capital. It typically involves less leverage (debt) compared to traditional LBOs. Minority recapitalizations are suitable for companies with strong growth potential but require additional capital for expansion.

Hybrid Deal Structure:

A hybrid deal structure combines elements of both majority and minority recapitalization. The PE firm and the founder(s) jointly retain significant equity stakes, sharing control. Leverage is tailored to fit the company's financial health and growth objectives. Hybrid deals often include an earn-out mechanism, where the founder receives additional payments based on future performance. This structure balances risk and rewards for both parties.

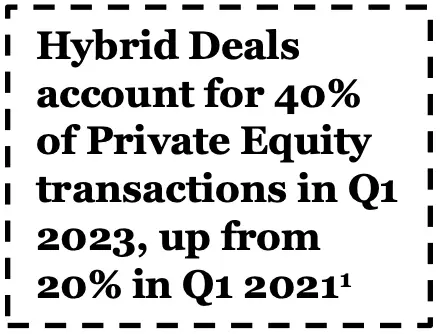

Hybrid deal structures are gaining popularity, particularly in dynamic sectors like technology, media, and telecommunications (TMT). These industries accounted for over 1,200 private equity deals in the U.S. in 2023. Hybrid deals offer the flexibility needed to support growth in these industries without overwhelming the founder's control over the business according to Statista.

Why Consider a Hybrid Deal Structure?

Alignment of Interests:

Hybrid deal structures align the interests of founders and PE firms. Founders maintain a meaningful equity stake, incentivizing them to drive growth post-acquisition. Simultaneously, the PE firm brings strategic resources and operational expertise without overwhelming the founder's control.

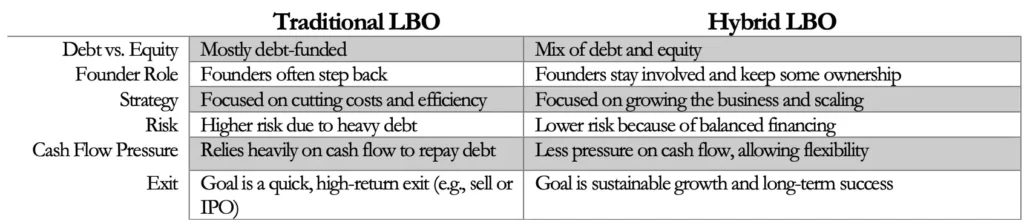

Key Differences Between the Traditional LBO and the Hybrid LBO Deal Structures

Source: Lakeview Growth Management

Flexibility in Financing:

The debt level in hybrid deals is moderated, reducing financial risk. This approach allows the company to pursue growth initiatives, such as acquisitions or market expansion, without excessive leverage. For instance, Blackstone's hybrid investment in Citrin Cooperman, a U.S.-based accounting firm, involved a moderate use of leverage to ensure financial stability while providing the company with access to Blackstone's strategic resources and capital.

Source: Lakeview Growth Management

Risk Sharing:

Both the PE firm and the founder share the risks and rewards of the company's future performance. Earn-outs or performance-based equity structures tie payouts to achieving agreed-upon milestones, ensuring mutual commitment to success. This risk-sharing mechanism ensures that both parties are equally invested in the company's long-term success.

Real-World Example of a Hybrid Deal

A notable example of a hybrid deal structure is Blackstone's investment in Citrin Cooperman, a U.S. accounting firm. In this transaction, Blackstone acquired a significant stake in Citrin Cooperman, valuing the firm at over $2 billion. The investment was structured to allow Citrin Cooperman's existing partners to retain operational control while benefiting from Blackstone's capital infusion and strategic expertise. This deal is a prime example of how hybrid structures can align interests by retaining control for the founders while providing financial support and resources from the PE firm.

Current Trends in Deal Structures

Traditional buyouts, where PE firms acquire majority stakes, remain prevalent due to their established track record and suitability for companies with predictable cash flows. However, the growing complexity of deal-making and economic uncertainty have driven interest in hybrid structures.

According to a Common Fund report, U.S. private equity aggregate deal value declined to $645.3 billion in 2023, down 29.5% from 2022 and 45.5% from 2021. This downturn has led to longer hold periods and a focus on value creation within existing portfolio companies. In this context, hybrid deal structures offer a balanced approach to investment, allowing PE firms and founders to adapt to evolving market conditions while sharing risks and rewards.

Hybrid structures are gaining traction in sectors like technology, media, and telecommunications (TMT), which accounted for over 1,200 private equity deals in the U.S. in 2023 according to Statista. These structures provide the flexibility needed to support growth in dynamic industries.

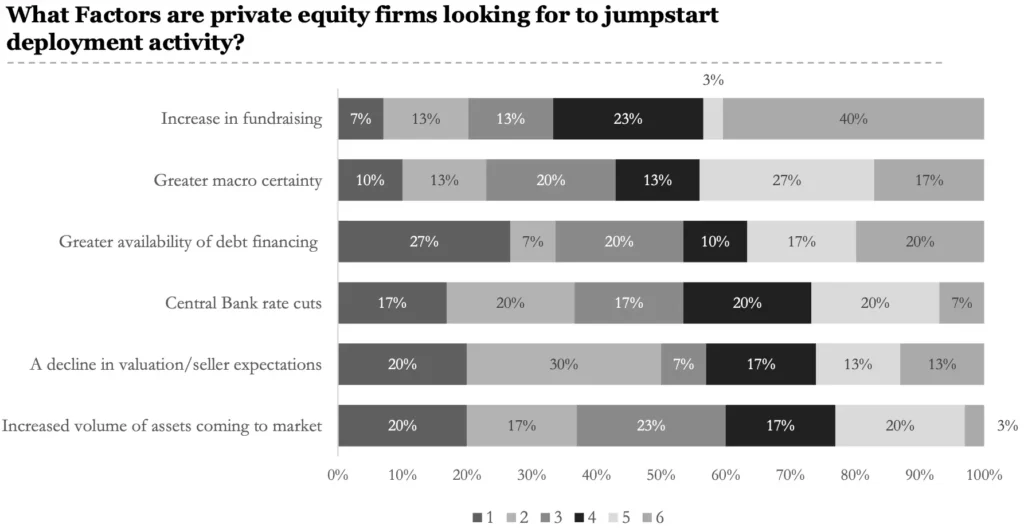

A key aspect driving the shift towards hybrid deal structures is the evolving market conditions and the factors that private equity firms are considering when deploying capital. For instance, according to a survey conducted by Alpha Sights, factors such as the increased volume of assets coming to market, a decline in valuations, and greater availability of debt financing are key drivers behind private equity firms' deployment strategies.

2Source: Survey conducted by AlphaSights

This chart reveals the priorities of private equity firms as they navigate an uncertain economic environment. As the market continues to shift, hybrid structures provide a strategic way for PE firms to balance risk, leverage, and growth opportunities.

How Founders Can Prepare for a Hybrid LBO

Enhance Financial Reporting:

Founders must present clear, accurate, and detailed financial statements that go beyond standard accounting. These reports should highlight predictable cash flows, demonstrate a track record of growth, and reflect the potential for scalability. Comprehensive financial transparency not only instills confidence in private equity investors but also positions the company for smoother negotiations during the deal process.

Understand Private Equity Valuation Metrics:

It's essential for founders to have a working knowledge of valuation methods commonly employed in private equity, particularly EBITDA multiples and other industry-specific benchmarks. Familiarity with these metrics equips founders to engage in more informed discussions about valuation and ensures alignment of expectations with potential private equity partners.

Prepare for Post-Deal Collaboration:

Founders should anticipate active involvement from private equity stakeholders post-transaction, particularly in areas like strategy, operations, and growth initiatives. Planning for a scalable business model that aligns with the firm's long-term vision can significantly improve the success of the partnership. This collaboration requires a mindset shift—from running a private company to working alongside institutional investors with clear performance targets.

Negotiate Balanced Terms:

Securing a deal that aligns interests on both sides is critical. Founders should focus on retaining meaningful equity stakes, defining clear governance roles, and incorporating performance-based incentives into the agreement. This approach creates a win-win dynamic, fostering a productive partnership that rewards both parties for achieving key milestones.

Conclusion

Hybrid deal structures in LBOs represent a middle ground that benefits both founders and private equity firms. By combining shared control, flexible financing, and performance-based rewards, these structures ensure alignment of interests and set the stage for long-term success. The use of moderate leverage and the ability to share risks through performance-based incentives make hybrid structures a compelling choice for founders looking to retain control while accessing the resources and expertise of a private equity firm.

For founders considering a private equity partnership, understanding deal structures is essential. Whether a traditional LBO or a hybrid structure is on the table, being well-prepared and aligned with your PE partner can unlock tremendous value for your company's future.

References:

- Preqin: Hybrid Fund Structures on the Rise as GPs Eye New Sources of Capital

- AlphaSights: What Factors are Private Equity Firms Looking for to Jumpstart Deployment Activity?